Published On May 14, 2022

This is a video about trading lessons.

FRACTAL FLOW WEBSITE: https://www.fractalflowpro.com/ (better seen on desktop!)

PRICE ACTION COURSES: https://fractal-flow-price-action.dpd...

STRATEGY STORE: https://fractal-flow.dpdcart.com/

INSTITUTIONAL TRADING EBOOKS: https://fractal-flow-institutional-tr...

CONTACT: [email protected]

This is a compilation of one hundred powerful trading lessons I learned over the last fifteen years of trading. These trading lessons will give you good insight about various matters regarding technical trading, risk management, and the so-called trading psychology. The goal here is that you avoid losing money and wasting time by standing on my shoulders. I learned the hard way so you don’t have to. Enjoy!

Chapters:

00:00:00 Intro.

00:00:37 Logical candlesticks.

00:01:38 Supply & Demand.

00:02:00 Different trading approaches.

00:03:19 Becoming fluent in the language of price.

00:03:54 The tip of the iceberg.

00:04:23 Screen time and theory.

00:04:54 Bar by bar and big picture analysis.

00:05:23 Paragraphs about price.

00:05:55 Contextual analysis.

00:06:22 Order and chaos.

00:06:50 Setups.

00:07:23 Both sides of the market.

00:07:54 Limitations.

00:08:20 Speculation.

00:08:52 Three ways of trading.

00:09:29 Transition between market scenarios.

00:09:54 Lag.

00:10:20 Lag in a non-lagging way.

00:10:50 Step outside technical analysis.

00:11:28 Pseudoscience.

00:11:54 Serious study of price.

00:12:22 Self-Fulfilling Prophecy Effect.

00:13:30 Linear tools and nonlinear problems.

00:14:11 Most of technical analysis is bad.

00:14:34 The weakest force.

00:15:13 Logical stop losses.

00:15:39 Realistic risk/reward ratios.

00:16:23 Being wrong most of the time.

00:16:58 Never decrease the risk/reward ratio mid-trade.

00:17:30 No reward without risk.

00:17:54 The lottery.

00:18:38 The casino.

00:18:56 Gambler’s Fallacy

00:19:34 Hot-Hand Fallacy

00:20:08 Martingale is bad.

00:20:56 Leverage is not a drug.

00:21:47 The number one killer.

00:22:23 The trader’s obligation.

00:22:58 Counterintuitive returns.

00:23:35 Standard deviation of returns.

00:24:21 Misleading performance.

00:25:04 Time horizons.

00:25:35 More than 60.

00:26:03 Serious “trading psychology”.

00:26:36 Cognitive biases.

00:27:02 Rationality.

00:27:32 Overconfidence elimination.

00:28:07 Hyperbolic discounting.

00:28:51 The Dunning-Kruger effect.

00:29:22 Spectrum of negative emotions.

00:30:21 Dialing down the negative emotions.

00:30:54 The amygdala hijack.

00:31:51 Revenge trading.

00:32:53 Over trading.

00:33:26 The fastest path.

00:34:15 Scalping & addiction.

00:34:52 The impersonal market.

00:35:36 The fool’s errand.

00:36:15 Not just discipline.

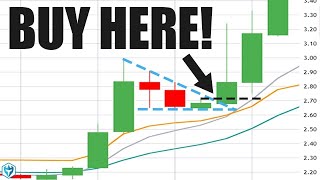

00:36:46 Trade location.

00:37:37 Delayed gratification.

00:38:15 Careful reading.

00:38:48 Retail vs Institutional scalping.

00:39:46 Back testing.

00:40:15 Uncertainty and imperfection.

00:40:43 You will not win every day.

00:41:14 Don’t ignore your achievements.

00:41:54 Study losers and winners.

00:42:31 Demo account.

00:43:03 Careful impulsivity.

00:43:39 Don’t blame others.

00:44:18 Not a way out of poverty.

00:44:57 Banks.

00:45:38 Statistical arbitrage.

00:46:13 Volatility x directional trading.

00:46:41 Arbitrage x directional trading.

00:47:07 Nondirectional trading.

00:47:38 Volatility and price.

00:48:14 Not a job.

00:49:15 Purposeless suffering.

00:50:01 Multiple time frames and contextual analysis.

00:50:44 Analysis paralysis.

00:51:14 Paradox of choice.

00:51:47 Market cornering.

00:52:42 Tripod of failure.

00:53:23 How to avoid progress.

00:53:52 Aim low and far.

00:54:28 Discipline and habit formation.

00:55:21 Opportunity cost.

00:56:08 Nobel prize winning ideas.

00:56:56 Hunter mentality.

00:57:36 Liquidity and volatility providers.

00:58:24 10,000 hours rule.

00:59:20 Finance and physics.

01:00:10 Finance and hydrology.

01:00:52 Markets are fractal.

01:01:42 Nature and culture.

01:02:12 Chaotic systems.

01:02:46 Brownian motion.

01:03:24 You can’t hide from your own mind.

01:04:41 Conclusions

#TradingLessons