Published On Sep 29, 2020

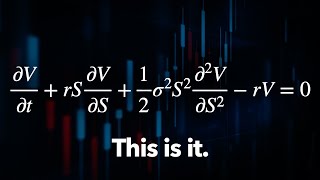

In this short video we describe a mathematical model for share price behaviour over time.

To do this we discuss Brownian motion, which you may know from science lessons, and how it is represented mathematically.

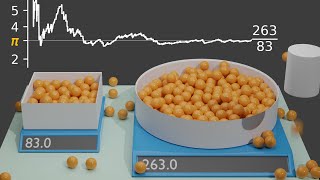

Like all mathematical models, our share price model involves unknown parameters. We explain some theory about how these

parameters can be estimated from data, and we illustrate this estimation using Marks and Spencer’s share prices over time.

We use the Taylor expansion of log(1 + x) to link our estimation process with the concept of relative return. Finally, we mention some drawbacks of the mathematical model

that we have described, and where this model is used in the study of financial markets and the products that derive from them.